Working as a frontalier with a Swiss cross-border commuter status using our payroll company

-

Share

Share

-

2y ago

2y ago

Who can benefit from payrolling, off- payroll working in Switzerland?

You are an individual or a consultant living in a country bordering France, Germany, Italy, Austria or any other EU/EFTA state:

Payrolling, off payroll working with the Swiss cross-border commuter status is the ideal solution to develop your activity, if you are in the following situations:

- You have proposals for mandates in Switzerland or would like to find clients there to develop your business while being or becoming a Swiss border worker

- You have already obtained a consulting mandate, a contract as a consultant

- You wish to evaluate a business creation project, a start-up projetc before creating your own entity

- You are prepared to return home at least once a week

You are a company based in Switzerland or abroad and you want to develop your business or engage freelance Consultants:

For a company in Switzerland or abroad, to use a payroll or umbrella company is the ideal solution to get people with Swiss cross-border commuter status to work on a mandate or a mission they have just obtained or to develop their business quickly, without having to hire them themselves.

What is payrolling, also called off-payroll working or “wage portage” in a few words?

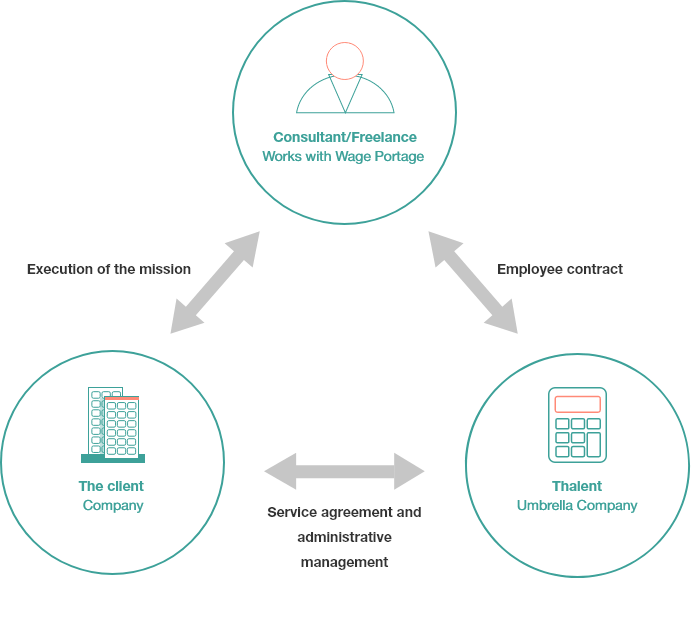

Payrolling is a hybrid form of work.

It allows an individual to carry out a mandate for a company in an autonomous way while benefiting from the social coverage provided by the status of employee.

Thalent SA signs a service contract with the client company that needs to work with the individual also called the consultant, and with the latter a Swiss employment contract.

At the end of each month, Thalent invoices the client company and pays a salary to the individual minus commission and employer and employee obligatory social charges.

As a consultant with Swiss cross-border commuter status working for one or more clients, the individual benefits from the full social security coverage available to all employees in Switzerland, including unemployment and full accident insurance to prevent any risks associated with business travel.

From a commercial point of view, they manage and prospect their clients in Switzerland themselves. They negotiate alone or with the help of Thalent their rates and the terms of the mandate with the client company.

On the contractual level, the person is autonomous. They manage and prospect their clients in Switzerland theömselves. They negotiate alone or with the help of Thalent their rates and the terms of the mandate with the client company.

Swiss cross-border commuter work permits, Swiss employment contracts, social security coverage and other administrative services

Thalent.com takes care of the following tasks:

- Arrangements for a Swiss cross-border commuter work permit G

- Employee working contract (definite, non definite period or hourly contract)

- Drawing up of service contract with the client company

- Invoicing, management of collections or reminders

- Managing VAT, if you are concerned

- Management and payment of employer and employee social security contributions and all accident insurance

- Reimbursement of travel and other business expenses

- Tax optimisation and advice

The status of cross-border commuters has changed

EU/EFTA nationals are no longer subject to border zones. They can live in any EU/EFTA state and work anywhere in Switzerland.

Citizens who live in an EU/EFTA country and work in Switzerland (employees or self-employed persons with their company headquarters in Switzerland) are considered to be border residents. The only rule is that these workers are required to return to their main residence (abroad) at least once a week.

Advantages for Swiss cross-border commuters

- Be able to reside in the border area or in an EU/EFTA country but be able to work in Switzerland

- Be fully insured for social security, compulsory labour insurance and pensions

- Receive a salary paid at the end of the month based on the turnover and smoothed over a determined period of time

- As Thalent performs the administrative and accounting tasks, the consultant can devote himself/herself to the execution of his/her mandate(s)

Advantages for companies

- Establishing the relationship is quick and easy: the person only needs to be domiciled in an EU/EFTA country and to return home at least once a week

- Compliance with the law. The Swiss or foreign company can be sure to work with a person who is in full compliance with Swiss law

- You gain flexibility as you can cope with higher variations in workloads without having to increase the payroll

- Cross-border consultants for the Swiss market are hired with a Swiss employment contract

- We take care of the formalities for the G work permit

- The employee works for your company

- At the end of the month we send you an invoice containing a summary of the work done by the consultant for you

- The consultant then receives a salary like any other employee

- All charges are paid

- You have no start-up or exit fees

- There is no minimum contract duration

- You benefit from the advice of our experts

Some figures on cross-border commuters in Switzerland, their number and occupation?

Number of Swiss cross-border commuters:

According to the Federal Statistical Office (FSO) publication «Cross-border commuters in Switzerland from 1996 to 2020» there are 343’000 cross-border commuters working in Switzerland at the end of 2020.

The largest number, 90’000 people, work in the Canton of Geneva.

Residence:

Most of them come from neighbouring countries and work in a neighbouring canton, in the border regions where they make up a significant proportion of the workforce.

More than half of them live in France (55%), almost a quarter in Italy (23%) and almost a fifth in Germany (18%). Less than 3% of cross-border commuters come to work in Switzerland from Austria or Liechtenstein, while those from other countries accounted for 0.7% of the employed population.

% of active, working population:

Cross-border commuters account for 6.7% of the employed population, and their share of total employment was 29% in the canton of Ticino and 24% in the canton of Geneva. The proportion of cross-border commuters is also high in the cantons of Jura (19%), Basel-Stadt (18%), Basel-Land (14%) and Neuchâtel (12%).

Occupation of cross-border commuters by sector:

The majority of cross-border commuters, like the resident workforce, work in the service sector. 77% of the resident workforce and 67% of cross-border commuters work in the services sector.

Many consultants using off-payroll working are Swiss cross-border commuters

Would you like to become a Swiss cross-border payrolling consultant or are you a company that needs to hire external consultants using our umbrella company?

Contact us now for more information!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming a freelance consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: KF

- Register for a free and non binding phone interview

- Subscribe free of charge and benefit from all our advantages

- Start your freelance activity

2y ago

2y ago