Our Blog

Family Allowances in Switzerland

In line with many countries, Switzerland operates a system of family allowances intended to partially offset the costs that parents incur in supporting their children. They include child and education allowances, as well as birth and adoption allowances introduced by individual cantons.

The notion that the state could and should help families raise and educate their children dates to the early 20th century, but we can find that such assistance began even in the 19th century in some European countries as a way to alleviate childhood poverty. Since their introduction, family allowance payments have undergone various changes and reforms in different countries, including changes to eligibility criteria, the level of payments, and the conditions attached to receiving them. These allowances still represent an essential means of backing up families and ensuring the well-being of children in numerous countries worldwide.

In Switzerland, debates regarding family protection support and allowances started around 1945, yet the implementation of such measures was a long process. Maternity insurance, for example, was not introduced until 2004.

How much is the allowance?

The Federal Law on Family Allowances (FamZG), or LaFAM in French-speaking Switzerland, stipulates the following allowances per child and month to be paid in all cantons:

- A child allowance of at least 200 Swiss francs for children up to 16 years of age or until the entitlement to education allowance arises. The amount varies by canton, and by the number of children in the household.

- An education allowance of a minimum of 250 Swiss francs for young people who are undergoing post-compulsory education, from the age of 15 at the earliest, up to the age of 25. The amount varies by canton and each defines what is intended by the education to be supported.

- A birth and adoption allowance is paid to help with costs of children born or adopted in Switzerland. The sum varies by cantons, some of which do not pay this sum.

Payment:

Child benefits are paid monthly to the parent or legal guardian by their employer, at the same time as their salary. Eligible families can claim a supplemental payment at the birth of their 3rd child and any subsequent children.

Self-employed individuals in Switzerland are required to adhere to the FamZG, entitling them to benefits while also obliging them to contribute financially. These individuals must be affiliated with a family compensation office in the canton where their business is located, and it is this entity that pays the allowance.

Who is eligible?

- Family allowance is paid to parents or legal guardians who reside in Switzerland and have at least one child under the age of 16. Some cantons may have different age limits or additional eligibility criteria

- Employees and self-employed individuals who do not work in agriculture (the latter category of workers benefit from a system governed at federal level).

- Unemployed people or people with a low income are also entitled to the allowance

- Cross-border (frontalier) workers: this category of workers is entitled to family allowances in Switzerland. However, if the frontalier’s spouse works in the border country, e.g. France, and their children reside there, then the country of residence of the cross-border worker, i.e. France, will be responsible for the payment of the family allowances. Swiss allowances will no longer be paid in this case, except as a differential supplement if the Swiss allowance amount is higher than the French allowance

Important to know:

- Funding: Child benefits are funded by the cantons and are not means-tested. All eligible families receive the same amount regardless of their income level.

- Tax implications: benefit payments count towards an individual’s taxable income and need to be declared as such.

- Application process: To receive family allowance benefits, parents or legal guardians must apply through their employer or appropriate cantonal office. The application process requires proof of residency, income, and family composition.

- Freelancers and consultants: if you are working through a salary portal company such as The Business Harbour, you will be able to request and receive family allowances in the same way as a full-time employee. The salary portal handles the administration for you and pays the benefit amount with your salary.

- Whilst subject to different claiming and eligibility criteria, Switzerland’s cantons offer additional financial aid programs for education, such as grants and scholarships and financial support to companies that hire apprentices, which in turn helps applicants become skilled workers.

Want to know more?

the Federal Social Insurance Office FSIO, OFAS is in charge of all social welfare policies in Switzerland :

https://www.bsv.admin.ch/bsv/en/home.html

The AVS website covers all aspects of the allowance, with comparisons between cantons and case examples to help understand what you may be able to claim and in which circumstances. :

https://www.ahv-iv.ch/en/Social-insurances/Family-allowance-FZ

Please feel free to contact us now for more information !

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming a freelance consultant. If you like our posts we would be thankful if you could give us a like on LinkedIn or Facebook!

Author: Antonina Marenco

-

Share

Share

-

1y ago

1y ago

How about hiring an off-payroll Task Force team through our umbrella company?

International organisations, government agencies, or companies regularly contact us when they are in the process of hiring several people for task forces or projects and seeking consultants or freelancers.

Task Forces, originally created by the United States Navy, are now used by many state and non-governmental organisations, associations and companies to carry out specific temporary ad-hoc assignments.

Employing external consultants, including both experts in their fields and junior staff on fixed-term assignments, is effective for this type of project.

Characteristics of a Task Force

Task Force working groups can be created in various situations to implement different strategies, but often in the case of

- Large projects

- High complexity projects

- Projects involving a significant amount of external resources

As a general rule:

- There is a chief project manager who has responsibility for the project

- The project becomes an independent structure

- Each participant works full time on the project

- The project is concise, with a specific number of members and consultants

- The group is agile, task-oriented, responsive and productive

- The group brings together talents from different backgrounds, departments, or sectors to bring innovation, better solutions but also to remove risks and poor results

- The group wants to accomplish a specific task in a specific time frame

- The participants are transferred from their original department or assignment or recruited ad hoc for the project under the guidance of the project leader. There may be a mix of people from within the organisation and with external people

- External consultants are usually highly qualified and experts in their field

- Junior consultants and even students on secondment may also be used

What types of organisations and departments use Task Forces?

In a state organisation, all departments and adjacent organisations can be involved:

- Health, sports, scientific research

- Interior, economy, finance, international cooperation

- Human resources, training, education

- Agriculture, environment, spatial planning

- Security, territorial protection, police

- Education, universities

- Universities, research institutes

All international governmental and non-governmental organisations, such as the UN, regularly use task forces:

- Economic Commission for Europe

- United Nations Conference on Trade and Development (UNCTAD)

- WHO (World Health Organisation)

- UNICEF (United Nations Children's Fund)

- Office of the United Nations High Commissioner for Human Rights

- UNHCR (United Nations High Commissioner for Refugees)

- UNESCO (United Nations Educational, Scientific and Cultural Organization)

- FAO (Food and Agriculture Organization of the United Nations)

- UNDP (United Nations Development Programme)

- UNEP (United Nations Environment Programme)

In a company, the departments that may be involved are:

- Human Resources

- Marketing

- Sales

- Public relations

- Accounting, finance

- Legal department

- Research & Development

- Manufacturing, fabrication

- Quality control

- IT

Examples of Task Forces created for a state, an international organisation or a company

State, State Council, Department of Economics

Issue: Like other professional organizations, a state council or canton aims to boost employment in particular sectors and employee categories by assisting companies in transforming their business models.

Solution: It sets up a dedicated task force to carry out this task. It must present to the state

a whole range of analyses and measures, but also develop training.

Solution: The task force is made up of representatives from various government departments, representatives of employers' associations and trade unions, as well as freelance consultants who are experts in their fields and who have been commissioned to advise on specific elements of the state council's mission.

International Health Organisation

Issue: A global international organisation is tasked by EU and EFTA countries with coordinating a European environment-related health process. Progress towards the goal is steered by a series of conferences held every 5 years.

A new priority has arisen in the area of nuclear waste storage related to electricity generation.

Solution: The Task Force is composed of officials from WHO states, intergovernmental and non-governmental organisations (IGOs/NGOs) as well as scientific experts from several countries who will work for the Task Force on a fee-for-service basis as scientific consultants.

Human ressources

Issue: The human resources department is responsible for the general function of recruiting new staff. But the organisation needs a specific study: "Hiring needs and challenges for the next decade".

Solution: It decided to set up a task force to prepare this specific report, which included people from various internal departments but also external consultants specialising in freelance work with a mandate for the duration of the project.

Crisis management: product safety, product recalls, public relations

Issue: A well-known food company is confronted with a food poisoning incident, such as salmonella or E. coli. This is a major crisis because it can lead to a drop in sales and legal action.

Solution: The CEO of the company orders a recall of all contaminated products and sets up a task force to execute the recall within 48 hours. Internal scientists are assigned to investigate the source of the poisoning.

External PR and communications consultants are commissioned to advise and manage the company's representatives and also to set up a dedicated website.

Do you need to hire consultants with different levels of expertise for a Task Force?

You can assign several people from your organisation to work exclusively on the project but also work with external consultants on a freelance basis through Thalent.

Organisations and companies can benefit from the following special features and advantages:

- You can very quickly start working with the consultants of your choice: our team is very reactive

- We have standard pre-established contracts for a wide range of situations between organisations and Thalent and between consultants and an organisation

- Freelance consultants can be hired as part of the Task Force for short or medium term assignments or even on a per job basis

- We take care of payroll and personnel management so that you can focus on other important tasks

- You reduce the tax costs of your task force operation

- The freelance consultant is employed by Thalent and performs a service for you, he or she does not have the status of a freelancer and you do not need to hire them

- The consultant does not need to have a self-employed status

- Thalent sends an invoice at the end of each month for the services performed by the consultant, the expert, which you pay as you would for any other supplier

- Consultants can work with hourly, daily, weekly or monthly rates

- We pay all social charges, taxes, insurance and take care of work permits if necessary

If you would like to know more, contact us now for more information!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming a freelance consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: Kamil Fetouni

-

Share

Share

-

2y ago

2y ago

- Register for a free and non binding phone interview

- Subscribe free of charge and benefit from all our advantages

- Start your freelance activity

Join Us in 3 Easy Steps

To receive an example of your income, please complete the form below

Payrolling or Freelancing for non-governmental or non-profit organisations in Switzerland

Do any of the following scenarios correspond to your situation?

- You are seeking to work as a consultant for an NGO or a non-profit organisation:

- You are a Swiss, EU or EFTA citizen, or a citizen of another country with a work permit for Switzerland

- You can have the possibility to access a work permit in Switzerland for other reasons

- You already have or could have access to a Ci permit because you live with a holder of a FDFA legitimation card

- You are an NGO or a non-profit organisation looking to work with freelance consultants

Then you can use our payroll services to carry out the mandate.

Non-governmental and non-profit organisations in Switzerland

There are many non-governmental and non-profit organisations in Switzerland.

Many international or foreign NGOs are also located here because of the presence of the European headquarters of the United Nations in Geneva.

The most important of these are the United Nations (UN), the International Committee of the Red Cross (ICRC), the World Health Organisation (WHO), the World Intellectual Property Organisation (WIPO), the International Telecommunication Union (ITU) and many other charitable, cultural and educational organisations.

In addition there are many associations and foundations in Switzerland. The exat number is not known as there is no legal obligation in Switzerland to register a non-profit organisation. They enjoy a high level of credibility.

These organisations play an important role in the promotion of:

- Humanitarian law, human rights, migration

- Humanitarian aid

- Labour, economy, trade, science, telecommunications

- Peace, security, disarmament

- Health

- Environmental preservation and sustainable development

Consultant profiles:

Non-governmental and non-profit organisations in Switzerland regularly recruit freelance consultants and they are in demand of many types of roles, including :

- Organisational Development Consultant

- Programme evaluation consultant

- Project Management Consultant

- Talent acquisition consultant

- Communication and marketing consultant

- Financial Management Consultant

- Recruitment and Talent Management Consultant

- HR systems and processes consultant

- HR and Governance Consultant

- Training and Development Consultant

- Diversity, equity and inclusion consultant

NGOs, Foundations, Associations, some figures

In Switzerland there are 45 international organisations, 42 of which are located in the lake Léman area and 39 in the Canton of Geneva. There are also 314 international non-governmental organisations (INGOs), of which 276 are in Geneva. Geneva also has 750 non-governmental organisations (NGOs).

More than 30 international sports federations have their headquarters in the canton of Vaud.

In Switzerland as a whole, there are more than 12,000 foundations and many more associations.

As of March 2022, 28,740 people work in the canton of Geneva’s 39 international organisations. Taking into account the 4,183 people employed in the permanent missions accredited to the UN or other international organisations and the consulates, the international public sector numbers 32,923 people.

According to Federal Department of Foreign Affairs these NGOs in Geneva also represent :

- More than 4,700 visits per year by heads of state and government, ministers and other dignitaries

- More than 4,000 conferences per year, organised in person, by teleconference or in hybrid mode and attended by approximately 366,000 delegates from all over the world

Advantages for NGO or non-profit organisations of using a payroll company like Thalent

Organisations can face multiple obstacles when seeking to work with consultants. The most important of these are usually legal issues relating to contracts, work permits and even taxation.

The advantages for organisations:

- Quick start without the need for a branch office: by working with a payrolling company like ours an NGO can hire consultants based in Switzerland or in border areas within 48-72 hours

- Experts in payrolling, off payroll work for NGOs: you will be advised by our experts who have been working for many years with non-governmental, international and non-profit organisations

- International contracts: we can work and set up all types of contracts between you and us for your consultants: mandates, task forces, fixed or indefinite missions, international mandates. All social charges and taxes are paid

- Compliant with Swiss law: our contracts comply with Swiss law and guarantee you complete legality throughout their duration. We take care of the relations with the tax authorities or the population office for work permits

- Offices in Geneva and Zurich: our offices are located in Geneva, headquarters of many international organisations, but also in Zurich. We also offer coworking and office sharing

Advantages for consultants of working for an NGO using our payroll solutions

Consultants who wish to work with an NGO, INGO, association or foundation without being employed by them can do so via our payroll company.

The advantages for consultants:

- You work for the organisation in a perfectly legal and autonomous manner

- You become an employee of Thalent and benefit from full social security coverage:

- Unemployment, AVS pension, 2nd pillar LPP, accident insurance, maternity allowance

- You benefit from paid holidays

- We take care of the formalities for your work permit

- We take care of your deductible professional expenses

- We advise you on your taxes

- This leaves you free to concentrate on your mandate without having to worry about accounting, legal and administrative matters

Job boards, Swiss NGO, INGO, non-profit organisations

Job offers for mandates in this type of organisations are published on standard job sites but there are also specialised sites.

Here are the most important sites specialised in recruitment for NGOs in Switzerland:

- Job portal of the United Nations

- Recruitment centre for the Geneva Welcome Centre (CAGI)

- Swiss Competence Centre for International Cooperation

- The ReliefWeb humanitarian information service

Two examples of NGO consultant profiles:

Elisabeth, communication consultant

Elisabeth is a freelance communications consultant with a passion for independent and international media.

She is single, Canadian, with a C permit and grew up in Geneva, Switzerland. She is fluent in French, English and Spanish, and studied Italian for a few years.

After graduating from university with a degree in communication and international relations, Elizabeth started working for an NGO that supported independent media in developing countries. She has worked on many exciting projects that have contributed to strengthening press freedom and democracy.

Because of her experience and expertise in the field of international communication, Elizabeth was recruited to work as a freelance consultant for a Geneva-based NGO that supports social justice in African countries. In this role, she works with journalists, media organisations and NGOs around the world to promote press freedom and access to information.

As a single woman in her thirties with no children, Elizabeth is, thanks to payrolling, able to focus completely on her mission whilst managing her time flexibly. She travels for her work and outside of it enjoys exploring new places, discovering new cultures and meeting people involved in the press. She also enjoys spending time with friends and family, and is very active in her local community.

Salah, organisational development consultant

Salah is an organisational development consultant working as a freelance consultant for a large UN agency.

Moroccan-Swiss, Salah grew up in Switzerland. He studied political science and business management at university in Paris and then started his career in the international field.

Salah worked for many years for a company specialising in financial services, before joining a UN agency as an organisational development consultant. In this role, he helps organisations to improve their effectiveness, sustainability and social impact.

He is married and has two children. His family is very important to him and he spends a lot of his free time with them. Thanks to his parents he has been able to keep a strong link with his culture and roots.

As a Moroccan-Swiss, Salah is passionate about diversity and inclusion issues and works actively to promote these values within the organisation he works for. He is proud of his multicultural identity and feels that this is an asset in his work as an organisational development consultant.

Salah is an experienced and respected professional in his field. He chose to become a consultant four years ago in order to be able to work on a variety of projects and take on new challenges. He is convinced that organisational development is a key tool for building a more just and sustainable world.

Contact us for a free consultation!

Are you a consultant who wants to work with a non-governmental organisation (NGO) or a non-profit organisation, or such an organisation that wants to work with a freelance consultant?

Contact us now for more information!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming an independent consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: Kamil Fetouni

-

Share

Share

-

2y ago

2y ago

The Thalent team wishes you a Merry Christmas and a happy new year 2023!

Dear clients, dear partners, dear consultants, dear future consultants!

On behalf of the entire Thalent team, we wish you and your loved ones a happy holiday season and much success for the year 2023.

We thank you for your trust and loyalty and we look forward to working with you in 2023.

We wish you all the best

The Thalent.com team

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming an independent consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

-

Share

Share

-

2y ago

2y ago

Join us at the Salon RH at Palexpo, on October 5 and 6: All the information and our conference on Off-Payroll Working!

Thalent will be at the Salon RH on 5 and 6 October at stand C.04 in Hall 2: visit us and ask us all your questions !

Thalent.com, based in Geneva, Switzerland, has been offering Payroll solutions for over 20 years.

Our solutions help:

- HR managers, companies wanting to work with independent consultants

- Foreign companies without a branch in Switzerland, looking to expand by working with Swiss or cross-border consultants

And of course:

- Swiss or cross-border freelance consultants who want to benefit from the advantages of freelance administration

Some of our advantages:

- Multi-currency, multi-contract solutions

- A company run by consultants

- Premium service

Ask us all your questions and meet our team at stand C.04 in Hall 2.

You can also make an appointment in advance with one of our advisors on our website or call us directly at: +41 22 341 24 28

Book your ticket now !

Conference on Thursday 06.10 from 9h20 to 9h50 am: Off-Payroll Working and the future of work in a changing world

Presented in French by Michael Bender and Wanda Swetzer Bender, Managing Partners of Thalent Don't miss this conference which addresses the need for new contract models for the increasingly popular part-time jobs. Increasingly, companies need to find external recruitment solutions for flexible and hybrid working environments.

During the conference, use cases will be discussed on how our customers and consultants benefit from our solutions:

- Complex international and multi-currency situations

- Several parallel missions in Switzerland and abroad on a digital platform

- Advice for the « Future of Work » and « Smart Office »

- "Organisational resilience through professional risk management and business continuity"

Continuation of the conference with Jérémie Agboklu, Thalent consultant and the solution Siris+

In the second part of the conference, Jérémie Agboklu, Quality Safety Environment & IT Senior Consultant, will explain how he works with Thalent SA and describe the QSE Software service with the solution Siris+ that digitalises quality, safety and environment in your organisation.

Book your ticket for the conference here!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming an independent consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: KF

-

Share

Share

-

2y ago

2y ago

Which sectors are in need of personnel or consultants in Switzerland at the beginning of 2022?

To understand in which economic sectors and for which professions the need for qualified personnel is increasing, we can rely on several reliable sources.

SECO's monthly labour market report

SECO's monthly labour market report is a very good indicator of the demand for qualified personnel in the various sectors of the economy.

For the year 2021, the national unemployment rate, seasonally adjusted, has decreased from 3.3% to 2.4%.

If we compare December 2021 and December 2020, it fell by 25.6%. In the same period, the number of unemployed persons aged 50-64 fell by 17.1% to 7'776 and the number of advertised vacancies rose by 88.4% to 47'531, of which 33'503 are subject to the obligation to advertise.

The instrument of compensation for reduced working hours (RHT) has done much to mitigate the negative effects of the crisis on companies and workers, but hiring intentions are at a historically high level for this first quarter of 2022.

According to the SECO report, between December 2021 and December 2020, the sectors that saw the largest absolute positive changes excluding hotels, restaurants, trade and maintenance or repair of motor vehicles are:

- Construction and civil engineering

- Professional, scientific and technical activities

- Administrative and support service activities

- Health and social work

- Financial and insurance activities

- Electrical engineering, electronics, watches, optics

- Information and communication

These are economic sectors for which companies will need employees but also freelance consultants.

Manpower's Employment Outlook Survey

A very good indicator of the demand for qualified personnel is also the Swiss Employment Outlook Survey published by Manpower.

According to the latest survey, employers expect to increase their headcount in the first quarter of 2022 with net employment hires of +30%.

Hiring intentions are strong across the country, with Central Switzerland reporting that 50% of employers surveyed will hire, Mittelland 33%, Eastern Switzerland 38%, Zurich 33% and the Lake Geneva region 28%.

The growth sectors with the highest demand for qualified personnel are:

- IT

- Technology

- Telecommunications

- Computer Sciences

- Communications and Media

- Education, Health, Social and Government

- Industry

- Non-profit organisations

The Swiss Skills Shortage Index of the University of Zürich

Another indicator is the Swiss Skills Shortage Index of the University of Zurich (In German only).

According to the University of Zürich, the shortage of qualified personnel has increased significantly in the year 2021. The reason for this is the increase in the supply of employment contracts and the fall in the unemployment rate. The easing of the pressure on the skilled labour shortage due to the Covid-19 pandemic in 2020 is almost not felt anymore.

The following occupations are particularly affected:

- Engineering

- IT and technology

- Human medicine

- Pharmacy

Engineering, IT, Information, Communication, Computing, Technology: these sectors need qualified Consultants

Here are some more details and figures on these sectors which are the most promising and which lend themselves well to off-payroll working, payrolling in Switzerland.

According to the latest Unesco report, "Engineering for Sustainable Development", Switzerland, which is already facing a shortage of engineers, will see this shortage increase. According to the report, there will be a shortage of at least 25’000 engineers in Switzerland in the upcoming years in this field.

Following several EPFL studies, there is a strong demand for engineers in the following fields:

- Cybersecurity

- Data science

- Digitalisation, digital transformation

- Artificial intelligence

- Cryptocurrencies

- Digitalisation of construction (BIM)

According to the ICT journal, ICT for information and communication technologies, the IT market, which has already rebounded in 2021, stimulated by strong trends and those related to the pandemic, will continue to grow.

Switzerland will need some 117’900 additional ICT specialists by 2028. New graduates and foreign skilled personnel will not be enough to fill the gap and if training capacities are not increased, there will be a shortfall of 35’800 professionals.

Online businesses also need staff and consultants with demand increasing by 55% in 2020 and online logistics and online marketing roles being the most sought after.

A Capgemini study on IT budgets in 2022 for the DACH region (Germany, Austria, Switzerland) confirms that most companies and administrations are expected to invest a larger share of their IT budget in systems modernisation, while the share of spending on maintenance is decreasing.

The opportunity of off-payroll working, working with freelance consultants using our Umbrella Company

Payrolling, off-payroll working allows a company to work with people without having to formally recruit them. It allows consultants to find and work on mandates, while receiving a salary and being assured that all social charges, insurance and insurance cover is paid.

For the company seeking to work with one or more consultants for a short or medium term mission, payrolling allows:

- Avoid hiring permanent staff by not tapping in the payroll budget

- To establish contracts with highly qualified consultants

- Free yourself from the tasks of managing salaries and personnel

- Work with consultants based in Switzerland or across the border

- Reduce the tax costs of your operations

The consultant is hired by Thalent who sends an invoice at the end of each month for the services provided, which you pay as you would when paying any other service company or supplier.

By using external service providers on a freelance basis, your company avoids numerous restrictive and time-consuming administrative procedures and can optimise its project outsourcing strategy.

The opportunity of payrolling, off-payroll working, for the Consultant

Thalent SA establishes, takes charge of, manages or offers :

- A salaried employment contract (fixed-term, open-ended or hourly)

- Contract with your client(s)

- Invoicing, reminders, VAT management

- Reimbursement of travel and related expenses

- Free advice for customer contracts

- Relations with the tax administration, the Cantonal Office of Population and Migration (OCPM) which also gives out the work permits in Switzerland

- Paid holidays, the payment of the withholding tax

- Full social security cover with a choice of options for the LPP pension fund, 2nd pillar :

- AHV: Old-age and survivors’ insurance

- AI: Disability insurance and income compensation benefits

- AAP: Occupational Accident Insurance with SUVA and supplementary insurance

- AANP: Non-occupational accident insurance at SUVA and supplementary insurance

- RC: Adapted professional liability insurance

- MUV/AMat/MUV: Maternity allowance

- ALV, AC, ALV:Unemployment Insurance

- OP/LPP/BVG: Pillar 2 pension fund with a full choice of options among the plans available from the CIEPP Fund of the Fédération des Entreprises Romandes (FER)

You already have, or would like to have, or are about to sign a contract with a client? Then contact us now for more information and execute the mandate as a Freelance Consultant at Thalent.com.

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming a freelance consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: KF

-

Share

Share

-

3y ago

3y ago

Working as a frontalier with a Swiss cross-border commuter status using our payroll company

Who can benefit from payrolling, off- payroll working in Switzerland?

You are an individual or a consultant living in a country bordering France, Germany, Italy, Austria or any other EU/EFTA state:

Payrolling, off payroll working with the Swiss cross-border commuter status is the ideal solution to develop your activity, if you are in the following situations:

- You have proposals for mandates in Switzerland or would like to find clients there to develop your business while being or becoming a Swiss border worker

- You have already obtained a consulting mandate, a contract as a consultant

- You wish to evaluate a business creation project, a start-up projetc before creating your own entity

- You are prepared to return home at least once a week

You are a company based in Switzerland or abroad and you want to develop your business or engage freelance Consultants:

For a company in Switzerland or abroad, to use a payroll or umbrella company is the ideal solution to get people with Swiss cross-border commuter status to work on a mandate or a mission they have just obtained or to develop their business quickly, without having to hire them themselves.

What is payrolling, also called off-payroll working or “wage portage” in a few words?

Payrolling is a hybrid form of work.

It allows an individual to carry out a mandate for a company in an autonomous way while benefiting from the social coverage provided by the status of employee.

Thalent SA signs a service contract with the client company that needs to work with the individual also called the consultant, and with the latter a Swiss employment contract.

At the end of each month, Thalent invoices the client company and pays a salary to the individual minus commission and employer and employee obligatory social charges.

As a consultant with Swiss cross-border commuter status working for one or more clients, the individual benefits from the full social security coverage available to all employees in Switzerland, including unemployment and full accident insurance to prevent any risks associated with business travel.

From a commercial point of view, they manage and prospect their clients in Switzerland themselves. They negotiate alone or with the help of Thalent their rates and the terms of the mandate with the client company.

On the contractual level, the person is autonomous. They manage and prospect their clients in Switzerland theömselves. They negotiate alone or with the help of Thalent their rates and the terms of the mandate with the client company.

Swiss cross-border commuter work permits, Swiss employment contracts, social security coverage and other administrative services

Thalent.com takes care of the following tasks:

- Arrangements for a Swiss cross-border commuter work permit G

- Employee working contract (definite, non definite period or hourly contract)

- Drawing up of service contract with the client company

- Invoicing, management of collections or reminders

- Managing VAT, if you are concerned

- Management and payment of employer and employee social security contributions and all accident insurance

- Reimbursement of travel and other business expenses

- Tax optimisation and advice

The status of cross-border commuters has changed

EU/EFTA nationals are no longer subject to border zones. They can live in any EU/EFTA state and work anywhere in Switzerland.

Citizens who live in an EU/EFTA country and work in Switzerland (employees or self-employed persons with their company headquarters in Switzerland) are considered to be border residents. The only rule is that these workers are required to return to their main residence (abroad) at least once a week.

Advantages for Swiss cross-border commuters

- Be able to reside in the border area or in an EU/EFTA country but be able to work in Switzerland

- Be fully insured for social security, compulsory labour insurance and pensions

- Receive a salary paid at the end of the month based on the turnover and smoothed over a determined period of time

- As Thalent performs the administrative and accounting tasks, the consultant can devote himself/herself to the execution of his/her mandate(s)

Advantages for companies

- Establishing the relationship is quick and easy: the person only needs to be domiciled in an EU/EFTA country and to return home at least once a week

- Compliance with the law. The Swiss or foreign company can be sure to work with a person who is in full compliance with Swiss law

- You gain flexibility as you can cope with higher variations in workloads without having to increase the payroll

- Cross-border consultants for the Swiss market are hired with a Swiss employment contract

- We take care of the formalities for the G work permit

- The employee works for your company

- At the end of the month we send you an invoice containing a summary of the work done by the consultant for you

- The consultant then receives a salary like any other employee

- All charges are paid

- You have no start-up or exit fees

- There is no minimum contract duration

- You benefit from the advice of our experts

Some figures on cross-border commuters in Switzerland, their number and occupation?

Number of Swiss cross-border commuters:

According to the Federal Statistical Office (FSO) publication «Cross-border commuters in Switzerland from 1996 to 2020» there are 343’000 cross-border commuters working in Switzerland at the end of 2020.

The largest number, 90’000 people, work in the Canton of Geneva.

Residence:

Most of them come from neighbouring countries and work in a neighbouring canton, in the border regions where they make up a significant proportion of the workforce.

More than half of them live in France (55%), almost a quarter in Italy (23%) and almost a fifth in Germany (18%). Less than 3% of cross-border commuters come to work in Switzerland from Austria or Liechtenstein, while those from other countries accounted for 0.7% of the employed population.

% of active, working population:

Cross-border commuters account for 6.7% of the employed population, and their share of total employment was 29% in the canton of Ticino and 24% in the canton of Geneva. The proportion of cross-border commuters is also high in the cantons of Jura (19%), Basel-Stadt (18%), Basel-Land (14%) and Neuchâtel (12%).

Occupation of cross-border commuters by sector:

The majority of cross-border commuters, like the resident workforce, work in the service sector. 77% of the resident workforce and 67% of cross-border commuters work in the services sector.

Many consultants using off-payroll working are Swiss cross-border commuters

Would you like to become a Swiss cross-border payrolling consultant or are you a company that needs to hire external consultants using our umbrella company?

Contact us now for more information!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming a freelance consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: KF

-

Share

Share

-

3y ago

3y ago

You are planning to develop your business in Switzerland or Europe as a foreign company. Why not start quickly thanks to Thalent.com, payroll company?

Develop the activity of your foreign company in Switzerland

A certain number of American, French, English, Chinese or even companies from other countries aim to develop their activity in Europe or in Switzerland in order to expand their market. However, many of these companies do not yet have a base in Europe or Switzerland.

Switzerland for information technology, life sciences or medtech

Switzerland attracts many foreign companies in the fields of information and communication technologies, life sciences or medtech for image reasons.

According to the Conference of Cantonal Heads of Economic Affairs (CDEP), 220 foreign companies have chosen to establish themselves in Switzerland in 2020. The majority of the companies concerned come from France, the United States and China.

Setting up a company involves risks and takes time

Setting up a company such as a Joint stock company or a Limited liability company involves significant costs. There are the costs of setting up the company, the notary's fees, the lawyer's fees, the costs of registering patents, the costs of renting business premises, and all the other administrative costs. It is therefore a significant financial risk and the set-up process takes some time.

Use Thalent for the work with your specialists team or development officer

Foreign companies usually have identified competent people they would like to work with in their network or among specialists in order to develop their business.These people have European or Swiss nationality, live in Switzerland or in the neighbouring area or can come and live there.

Obligations for foreign companies from America, France, UK or China

These foreign companies, not having a company yet, are obliged to employ these people through another European or Swiss company.

You are such a foreign company. Why not call on us for your start-up in Europe or Switzerland?

Fast service set-up

Setting up the service is very quick and simple for Thalent: the person chosen by the company must be Swiss or of European nationality and must be domiciled in Switzerland or in the neighbouring regions. Thalent then makes a proposal for a permanent employment contract. Thalent then also signs a service contract with the foreign company.

To increase the credibility of this person, he or she can work with the contact details of Thalent.com This is left to the foreign company's choice.

Compliance with the law

By proceeding in this way, the foreign company, whether American, French, English or Chinese, is certain to have an employee in full compliance with Swiss law.

From an administrative point of view, it is also extremely simple because Thalent sends an invoice to the foreign company.

The consultant then receives a salary at the end of each month which includes all social charges and covers also all compulsory insurances, such as accident insurance for example.

Many companies have used our service

We have set up this service for a large number of companies. When their business has developed effectively, the company may decide to set up a branch office and thanks to our network, Thalent can help the company with all the formalities.

The advantages in brief:

- We hire your employee(s) for the Swiss market with a Swiss permanent employment contract

- We take care of the work permit formalities if necessary

- The employee works for your company

- At the end of the month we send you an invoice

- The employee receives a salary like any other employee

- All social charges are paid

- You have no registration or exit fees

- There is no minimum contract period

- You benefit from expert advice

Contact us now for more information!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming an freelance consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: KF

-

Share

Share

-

3y ago

3y ago

A comparison between Payrolling and the status of an Independent/Self-Employed

Payrolling or the status of an Independent/Self-Employed. What is better and why?

When someone chooses to become self-employed, the question of the legal status arises as one has to start invoicing one or more clients. Is it better to become self-employed or to work using a payroll or umbrella company?

In order to choose between payrolling and self-employed status, it is essential to be familiar with the specific characteristics of both statuses. In this article we summarise their main characteristics and provide an advanced comparison table which is also available in .pdf.

1. Independent or self-employed status in Switzerland

In Switzerland a person is obliged to have his status recognised by the cantonal compensation office.

The compensation office checks whether the status of self-employed person can be granted according to the criteria of the Federal Law on Old Age and Survivors' Insurance (OASI), the directives of the Federal Social Insurance Office (FSIO) and the case law of the Federal Court (FC).

The AHV/IV Information Centre provides a list of compensation offices. In Geneva, for example, the main AHV compensation office is the OCAS. It is this office that can recognise your self-employed status.

The particularities and difficulties are as follows:

- To obtain the status, you have to provide a whole set of documents and prove that you have at least 3 clients

- One of the particularities in Switzerland is that you must have already started your activity

- The process takes several weeks and the status is not necessarily granted

- You cannot be insured for unemployment

- If you are granted the status, you have to contract by yourself:

- An accident insurance covering occupational and non-occupational accidents and occupational diseases

- A loss of earnings insurance which allows you to receive your salary in the event of illness

- A professional liability insurance, which covers material and physical damage caused to third parties in the course of professional activity

- Depending on the activity carried out, some insurance policies are compulsory (civil liability, fire insurance), others optional (legal protection, theft, etc.)

- You can use your 2nd pillar and withdraw it, but you must withdraw it in its entirety. If you are married, your spouse must approve the withdrawal

- You must keep accounts for the annual tax return and are subject to VAT on sales over CHF 100,000

2. Payrolling over an umbrella company in Switzerland

The particularities and advantages are as follows:

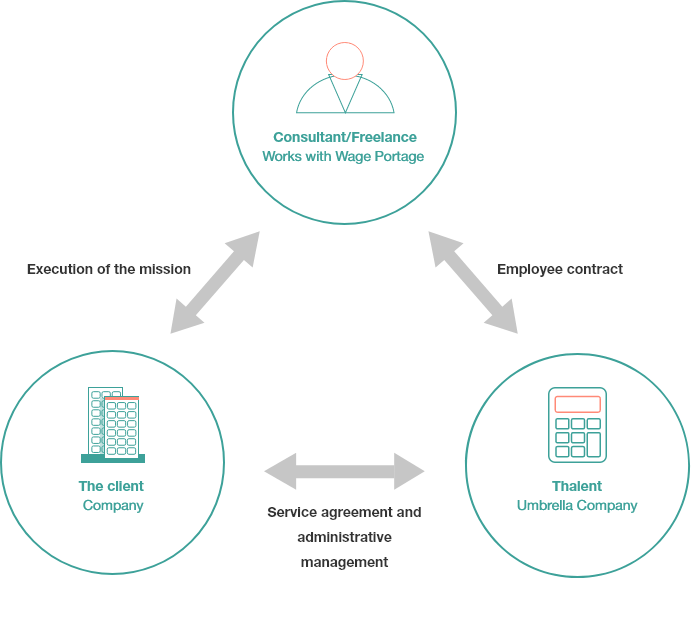

- Payrolling involves a three-way contractual relationship:

- You, the Consultant

- Your client company

- The payroll or umbrella company, such as Thalent SA

- 2 contracts are established:

- A permanent employment contract between you, the employee and the payroll company

- A service contract between the client company and the payroll company

The big advantage of Thalent is that you receive a permanent contract, as opposed to other companies that establish payrolling contracts. Contact us to find out more.

- You are fully covered by social security: unemployment, AVS pension, 2nd pillar LPP

- All accident insurance, maternity allowance are included

- You benefit from paid holidays

- You can start your activity directly if you have only one client, for example, once you have signed the 2 contracts mentioned above

- You do not have to worry about administrative tasks such as invoicing, reminders, work permits

- You don't have to do any accounting

- A company like Thalent will help you to optimise your tax returns

- The payroll company charges you of course a fee for these services

Our opinion and our comparison table

If you don't know how to go about it and how the independent status works, payrolling is undoubtedly the most effective solution. Moreover, you can start directly and if you work with Thalent without any start-up costs.

In our opinion, it is better to start your activity as an independent, self-employed only once you have the necessary know-how and number of clients, to become so.

The fact that you cannot benefit from unemployment insurance will not change if you are self employed in Switzerland.

Our experience :

At Thalent some of our consultants who started out as payroll Consultants have gone on to become self-employed or have set up a company, only to return later again to payrolling because it was not worth it for them. It all depends on your situation, your needs, the way you work, the type and number of your clients and whether you want to take care of the administration or not.

Still want to become an independent ?

In this case, we recommend our partner karpeo.ch and their chartered accountants who can help you with the administrative procedures to obtain your self-employed status.

Now go straight to the:

Comparison table between Payrolling and the status of an Independent/Self-Employed

Or download the corresponding .pdf!

Besure to regularly check our homepage and follow us on our social networks for more information regarding payrolling and becoming a freelance consultant. If you like our posts we would be thankful if you could give us a like on Linkedin or Facebook!

Author: KF

-

Share

Share

-

3y ago

3y ago

1y ago

1y ago

1y ago

1y ago

Share

Link Copied